Bankruptcy Chapter 11

If you are a business owner who is struggling to meet your financial obligations to your creditors, you may be eligible to file for one of the following types of bankruptcy either Chapter 7 or Chapter 11, which is sometimes referred to as "reorganization." Unlike Chapter 7 bankruptcy that involves liquidation of assets, in a Chapter 11 case, you will remain in control of your operations and get time needed to restructure your debts, while a court-assigned trustee oversees your operations.

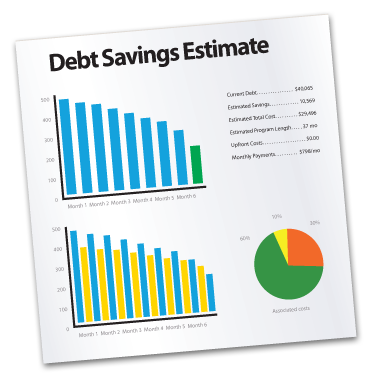

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few online questions. It's free and there's no obligation.

Basically, the Chapter 11 process allows debtors to propose a plan that will allow them to keep their assets. Under Chapter 11, you will typically assume the role of "debtor in possession," and in this role, you need to account for the property, examine claims by your lenders, and file all reports that are requested by the court. Keep in mind, though, that Chapter 11 filers are allowed to enlist the services of a bankruptcy attorney who can help them prepare a reorganization proposal. The same holds true for individuals who file personal bankruptcy; in most cases, hiring an attorney will streamline the process and eliminate any potential mistakes that may arise.

Be careful not to confuse Chapter 11 vs. other types of bankruptcy, but if you do, it's perfectly understandable. These days, the information available about bankruptcy laws may sometimes be confusing to most people; that's why we put together this simple guide to help you understand how bankruptcy works and what your options are. As we mentioned earlier, Chapter 7 bankruptcy is another viable option for financially-strapped individuals and businesses. Known as straight bankruptcy, it involves the sale of all assets and results in the termination of the business. In contrast, Chapter 13 bankruptcy allows individuals to pay some or all of their debts through a court-approved repayment plan, and allow them to keep some of their assets. Then, there is what's known as Chapter 12 bankruptcy, which is similar to Chapter 13 in structure but is only available to family farmers and fishermen.

For a review of debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few questions online.

If you believe that going forward with filing for Chapter 11 bankruptcy protection is a good move towards rebuilding your business, you need to know about its eligibility requirements. First, a debtor is usually classified as an individual, a corporation, or a partnership. Second, debtors need to submit records of assets and liabilities, expenses, and any contracts or leases. You must also ask yourself if you can commit to appearing in court as well as adhering to any court requirements. Also, if you are attempting to file under Chapter 11 protection, you will typically need to show proof that you received credit counseling from a government-approved agency within six months before you filed. As you can see, Chapter 11 can be, in some cases, a good way for debtors to get a fresh startif they meet their obligations under its reorganization plan. But filing for Chapter 11 bankruptcy protection is often the most complicated of all cases, and may also cost more than the other types. If you are serious about putting your business in a better financial position, we can provide you with valuable information and contacts that can help you explore if Chapter 11 bankruptcy is the best move for you and your business.

To review debt relief alternatives to bankruptcy in Florida and to get a free debt relief analysis and savings estimate, simply answer a few online questions. It's free and there's no obligation.